It also enables timely decision-making based on up-to-date financial information. This occurs when the cost of goods sold is lower than the revenue generated from sales. Negative COGS can happen due to factors such as inventory write-offs, discounts, or rebates. However, it is relatively rare and should be thoroughly examined and validated. Analyze COGS trends over time to identify cost-saving opportunities and cost drivers. By understanding the factors influencing COGS, businesses can make informed decisions to optimize their production processes and reduce expenses.

Actionable tips for cost of goods sold in accounting

For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. He is the sole author of all the materials is cost of goods sold a contra account on AccountingCoach.com. For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

Balance Sheet

There are two major methods of determining what should be booked into a contra account. This type of account could be called the allowance for doubtful accounts or a bad debt reserve. The balance in the allowance for doubtful accounts represents the dollar amount of the current accounts receivable balance that is expected to be uncollectible. The amount is reported on the balance sheet in the asset section immediately below accounts receivable. The net of these two figures is typically reported on a third line. Generally Accepted Accounting Principles or “GAAP” is a set of accounting standards established by the Financial Accounting Standards Board (FASB) and the Governmental Accounting Standards Board (GASB).

Understanding Inventory Write-Offs

- The cost incurred in purchasing goods or services to sell them and generate revenue is called as the cost of goods sold.

- Labor costs may be allocated to an item or set of items based on timekeeping records.

- Accountants use contra accounts rather than reduce the value of the original account directly to keep financial accounting records clean.

- A contra asset account is an asset account where the account balance is a credit balance.

After year end, Jane decides she can make more money by improving machines B and D. She buys and uses 10 of parts and supplies, and it takes 6 hours at 2 per hour to make the improvements to each machine. Thus, Jane has spent 20 to improve each machine (10/2 + 12 + (6 x 0.5) ). If she used FIFO, the cost of machine D is 12 plus 20 she spent improving it, for a profit of 13. If she used LIFO, the cost would be 10 plus 20 for a profit of 15.

Sales returns and allowances:

A company must write off the inventory when these situations occur. For example, a stationery shop purchases 1000 pens and sells 200 of them. Now, the cost of the 200 units of pen will be the cost of goods sold for the stationery shop. Leverage the full capabilities of Lark Sheets to document, track and collaborate on your accounting projects initiatives. Double Entry Bookkeeping is here to provide you with free online information to help you learn and understand bookkeeping and introductory accounting. In other words, the account payable in the buyers’ book is reduced.

Astandard credit/debit transaction, if performed between Internal and Externalaccounts, would result in a failed trial-balance. The contra-account of FinishedGoods is used in External Accounting only at month end. The difference between an asset’s account balance and the contra account balance is known as the book value. Those who are struggling with recording contra accounts may benefit from utilizing some of the best accounting software currently available. By keeping the original dollar amount intact in the original account and reducing the figure in a separate account, the financial information is more transparent for financial reporting purposes.

To produce a bath soap, your company has to spend approximately $5 per soap on ingredients such as soap base, fragrance, and additives.

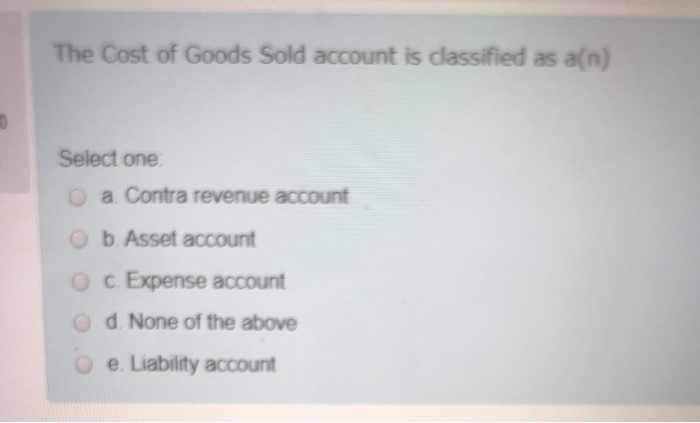

Retained earnings can increase or decrease over time based on dividend payouts and earnings. They’re effectively how much of its income a company has managed to save. A large inventory write-off such as one caused by a warehouse fire may be categorized as a non-recurring loss. The cost incurred in purchasing goods or services to sell them and generate revenue is called as the cost of goods sold. The account that is used track this cost is named as the Cost of Goods Sold account.

Once the buyer identifies these problems, the buyer will normally need to return the goods and then ask for returning cash or reducing the credit balance. This includes things like excess materials, defective products, and unused packaging. Improving your bottom line also means finding ways to automate and streamline processes. Operating expenses are expenses that are indirectly tied to producing the goods or services.

The inventory account will be credited and the inventory reserve account will be debited to reduce both when the asset is disposed of. This is useful in preserving the historical cost in the original inventory account. Establish robust cost accounting systems to accurately track and allocate costs to products. This helps in calculating COGS more precisely and provides valuable insights into the profitability of different products or product lines. On Feb 2, the journal entry to adjust inventory and record cost of goods sold account. Operating expenses help establish a budget for each department and evaluate the overhead costs spent by the company.

Among the potential adjustments are decline in value of the goods (i.e., lower market value than cost), obsolescence, damage, etc. Cost of goods sold (COGS) is the carrying value of goods sold during a particular period. The ABC cosmetics purchase product Y at $40 per piece and product Z at $20. These inventory/goods need to be stored and recorded in the warehouse. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.